Omaha 2023

This month, I visited Omaha, Nebraska, to attend the Berkshire Hathaway Annual General Meeting. This was my first time in the US since 2018, as Hong Kong’s COVID quarantines and a young family kept me away. The trip was also an opportunity for a long-awaited family reunion. I brought my mum along, and we arrived a week early to reconnect with my sister, an attorney in New York City, whom I haven’t seen since 2019.

Arriving early allowed us time to explore Omaha itself. It genuinely seems like a nice place to live - at least during summer. The city is compact and convenient, with many pleasant-looking parks and schools. We revisited the 2017 documentary 'Becoming Warren Buffett' and retraced the Oracle's steps. It's clear why he cherishes his hometown: its familiarity must offer a deep sense of comfort. And by keeping one aspect of his life constant, he can focus on optimising the rest.

There’s actually a lot to do in Omaha. We enjoyed hiking in Tranquility Park and Neale Wood. The brand-new Luminarian brought scientific concepts to life and even had thoughtful exhibits on investing and the power of compound interest. In a pure stroke of good luck, we caught Jason Isbell & The 400 Unit’s one-night-only show at the one-hundred-year-old Orpheum Theatre. This was particularly special for me as I played Isbell’s music for my son during his first car ride home from the hospital. There’s no better depiction of love than his song, “If We Were Vampires” (lyrics here).

But before all that, we made some good old-fashioned store visits. The list was extensive: Home Depot, Lowe’s, Nebraska Furniture Mart, Floor & Decor, Autozone, Walmart, Whole Foods, Baker’s (Kroger’s), Games Workshop, Benjamin Moore, Sherwin Williams, Domino’s Pizza, McDonald’s, Burger King, Chipotle, and Dairy Queen.

There’s a certain magic about seeing products on the shelves. And in America, the big box format really must be seen to be understood. The scale at which large chains operate there takes retail selection and efficiency to a level we can’t imagine in Hong Kong.

Store visits also let you appreciate the little details, like who paid to have their products placed on the shelves at eye level; how clean, well-lit and aspirational Berkshire-investee Floor & Decor felt; how insightful and helpful the Associates at the Home Depot Pro Desk were; or how a staffing shortage at Dairy Queen meant two-thirds of the menu was unavailable.

I couldn’t help but notice that virtually all stores were hiring, with starting wages of $15 to $18 an hour (plus benefits) well in excess of the $10.50 minimum wage Nebraska introduced this January. Indeed, prices seem high in absolute terms. Using The Economist’s heuristic index, the cost of a Big Mac combo in Omaha is roughly double that in Hong Kong. Most cafes and restaurants have transitioned to electronic POS (Toast more than Square), with a starting "suggestion" for tips at a staggering 25%. Has that become the new norm?

Truth be told, I had forgotten just how prosperous America is. I know the system doesn’t serve everyone equally or equitably. But in the aggregate, it has been exceptionally successful at creating wealth. And there is scant reason to doubt it will continue to do so. Buffett is not being modest when he credits America for his investment success.

Omaha itself is an affluent place. The city's prosperity in the late 19th and early 20th centuries is evident in the commercial buildings downtown and the stately homes of the Aksarben and Dundee neighbourhoods. The Durham Museum tells the story of Omaha's boom times, first as a supplier for those heading West and later as a railhead for produce moving back East. It is appropriately housed in the former Union Station, a grand old building which belies the Republican ideals of the era.

Drive down Farnam Street to Buffett’s house today, and you'll pass the University of Nebraska Omaha Medical campus, boasting a dozen or so buildings named after rich donors, each dedicated to a different medical speciality.

There’s a particular spirit of enterprise (or, more simply, “working hard to get ahead”) that I deeply admire about America and Americans. Buffett and Munger embody this and have attracted others who do too. I especially felt it at dinner among the Yellow BRKers, a humble group of farmers, lawyers, teachers and business people who have been Berkshire shareholders for decades (think about that). They have all strived in their own way and their own corners, and they have done well.

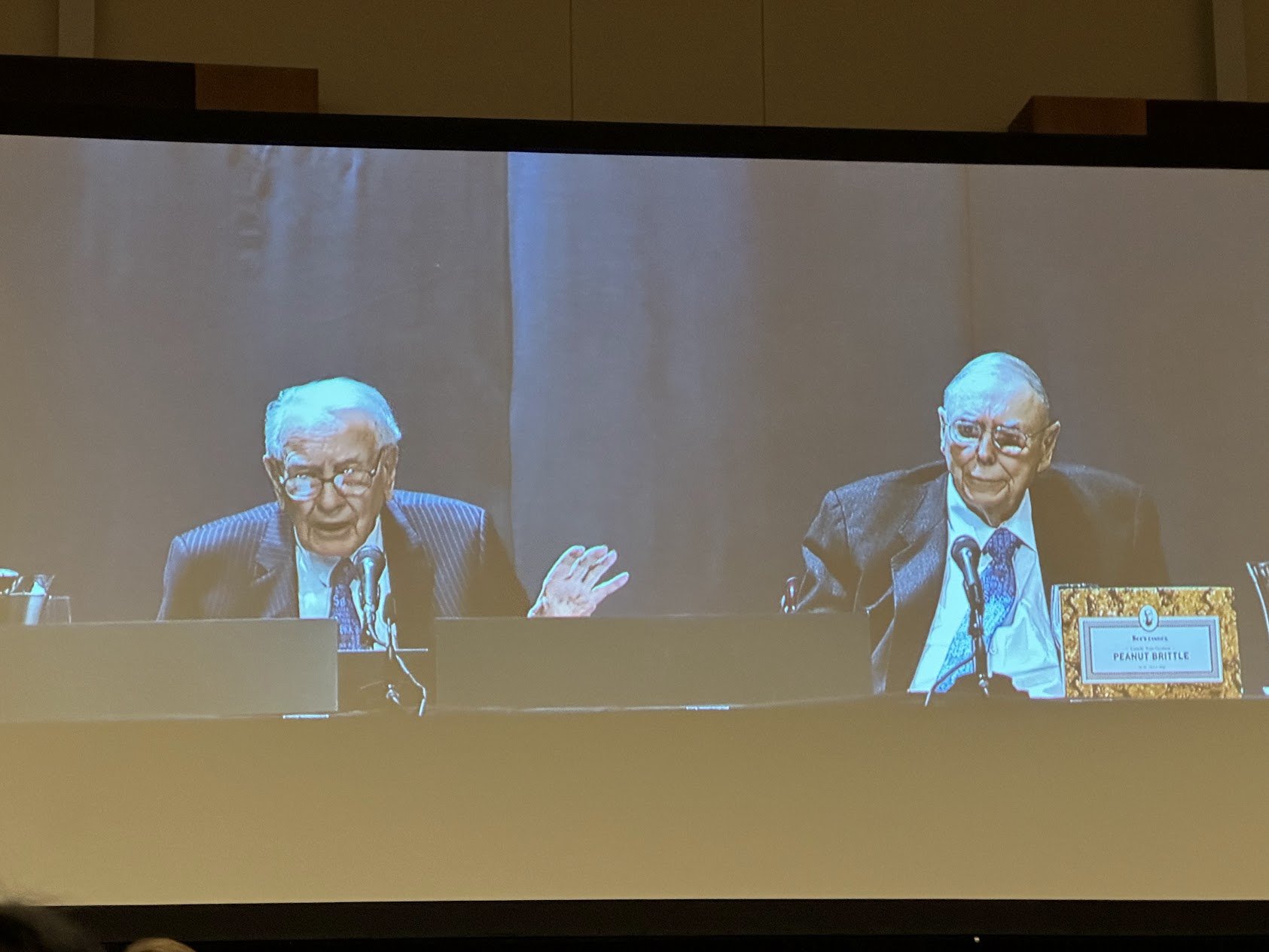

As for the meeting, Warren and Charlie were as sharp as ever, and I left with heightened confidence in the Berkshire machine, whose shares Warren hinted were currently undervalued.

The central question remains how to reinvest the profits and insurance float which gush in every month. Charlie praised Warren for the cool USD 5 billion he made investing in Japanese trading companies, but Warren humbly pointed out that the profits now represent barely 1% of Berkshire’s net worth.

Even after investing some USD 40 billion into Permian Basin shale oil plays Chevron and Occidental, Berkshire still sits on about USD 125 billion in cash and liquid securities. And with interest rates where they are, it will earn something like ten times more interest on that cash pile this year, further adding to its embarrassment of riches.

Warren's "elephant gun" is loaded and ready, but where are the elephants?

The discussion on GEICO’s ‘tech debt’ was revealing. Which other Berkshire subsidiaries have under-invested in software?

Unfortunately, the question I submitted to Becky Quick on TSMC and Apple didn’t make her cut. So we know that Warren didn’t sleep well with his USD 5 billion investment in TSMC because of the geopolitical risk. Fair enough. But we didn’t hear what that implies for his USD 140 billion investment in Apple, because without TSMC’s foundries, there will be no new iPhones.

Between meetings, I made sure to spend time visiting the exhibition hall. It felt emptier than in previous years, perhaps because few listed companies had stands and many small subsidiaries were grouped together. Berkshire’s collection of businesses is truly eclectic: from stuffed toys to cowboy hats, manufactured homes to party boats, running shoes to wind turbines. The common denominator must be a history of high returns on capital.

The exhibitors’ recent experience, by and large, mirrored the general economy: they cut capacity in 2020, rushed to add it back in 2021 and 2022, and are now facing overcapacity in 2023 as the economy cools. So, expect Berkshire’s operating companies’ margins to compress this year and earnings growth to cool.

It’s funny to say that the meeting was ‘full of the usual wisdom’. What does that even mean? Warren and Charlie have shared how they think and operate for almost sixty years. They’re not reinventing the wheel. The magic is in their consistency and focus. Theirs is simply an uncommon common sense.

I guess that’s why it felt like attending the AGM was like ‘taking communion’. It was a chance to revisit that unflappable common sense and then take stock of my own life and investments. Where can I do better? How can I make things simpler? And what do I need to improve my odds of success and happiness?

As Warren said, “If you want to figure out how to live your life, you write your obituary and reverse-engineer it”. Or even more directly, “I’ve never known anybody that was kind that died without friends”.

(He also said, “What gives you opportunities is other people doing dumb things. And in the 58 years we've been running Berkshire, I would say there's been a great increase in the number of people doing dumb things.”)

Attending the AGM and expecting to duplicate Warren and Charlie's investment success is akin to listening to Mozart and expecting to compose your own symphonies. These men are masters of their craft who emerged during a uniquely opportune period. We acolytes will need to forge our own paths.

And yet, regardless of who we are or our ambitions, there are lessons to glean from their journey.

To the friends I saw this year, it was wonderful to reconnect with you after such a long absence. You are what makes the trip worthwhile. And to the friends I made, it was a pleasure to meet you! To you all, I hope to see you again next year!